Private markets are the crown jewel of modern investment portfolios.

As demographics shift, a new generation of investors want access to alternative asset classes, while wealth managers face significant challenges to deliver that infrastructure, which is turning their world upside down.

40% of Australian wealth managers say a lack of access to private assets is a threat to their business

In Australia, portfolios currently comprise approximately 88% in public assets and 12% in private assets. This gap is expected to narrow as interest in private markets continues to intensify. Notably, 48% of wealth managers indicate that meeting client demand for unlisted assets will be a key driver of their future growth.

An increasing number of high-net-worth individuals are creating demand for alternative investments including private equity, early stage startups, cryptocurrency, and even more visibility to small-cap and micro-cap companies.

To attract new capital, fund managers must significantly enhance their technological capabilities, deliver superior investor experiences, and tap into a broader range of investment vehicles and asset classes to meet evolving client expectations.

Private market returns exceed public markets by a significant delta

Managed account sector surging globally Native portfolio reporting across public and private markets

Tax aware automated investment technology nascent

Wealth managers need automated efficiencies

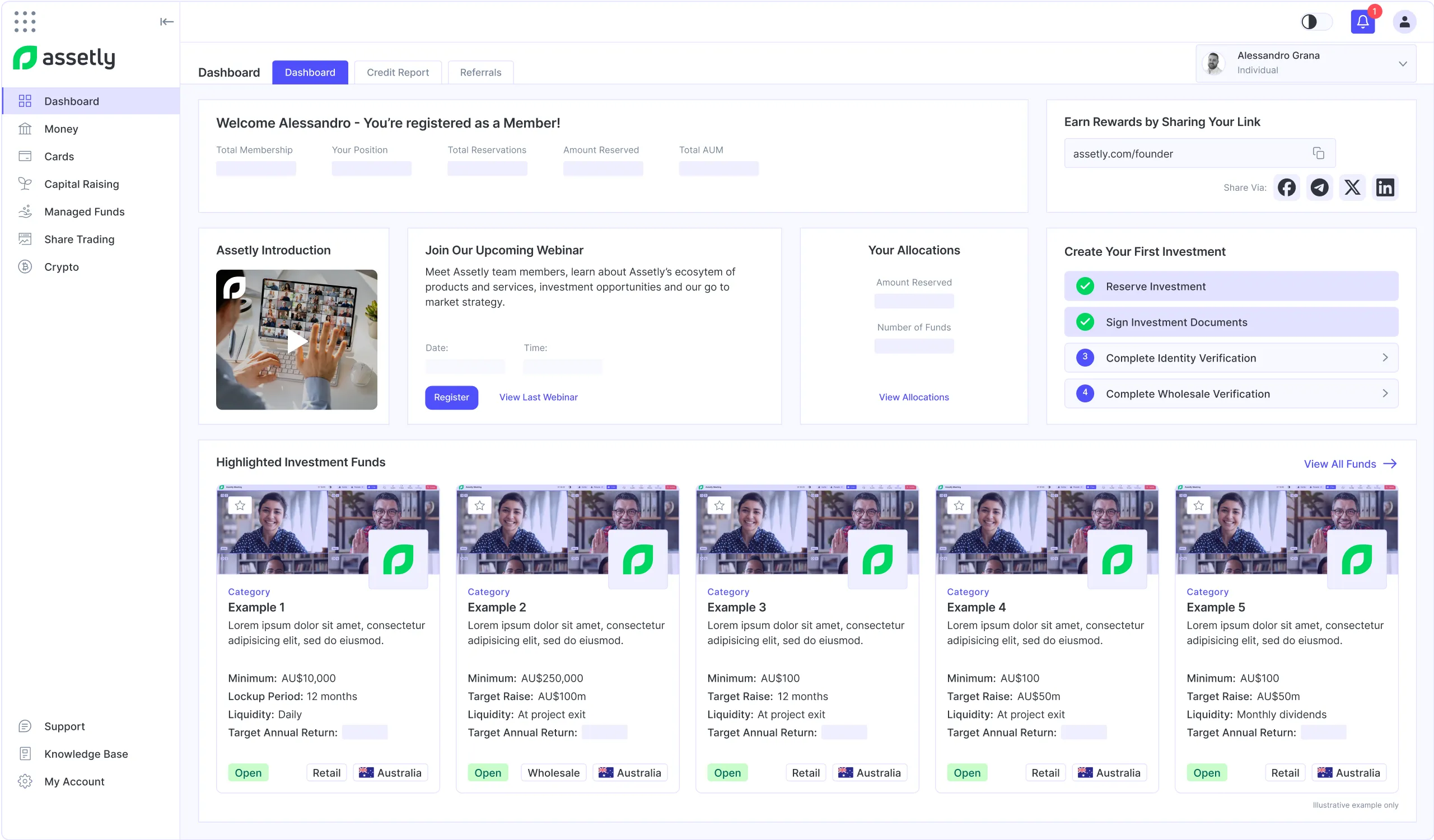

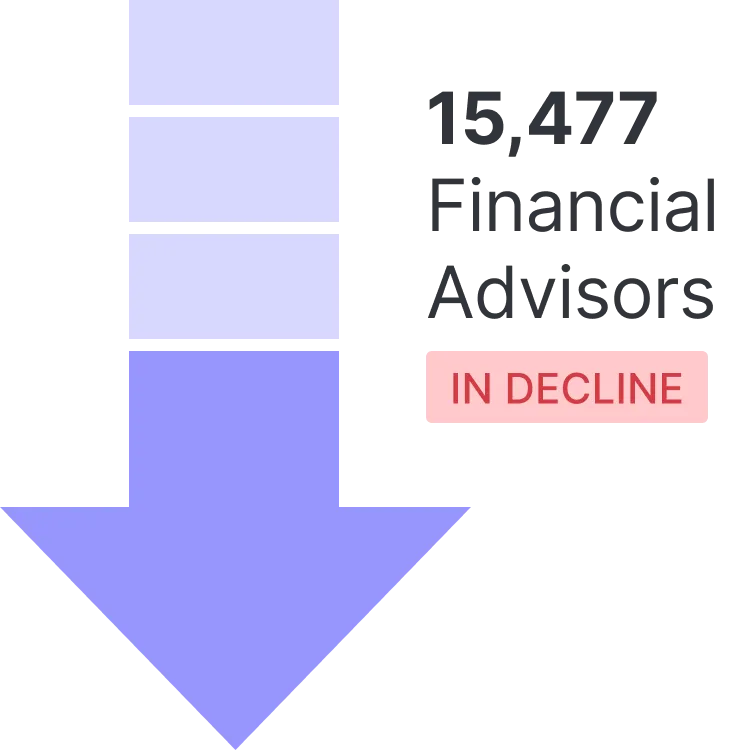

A Shift to Automation

Over the last 5 years the number of financial advisers in Australia has fallen from a peak of 27,959 in 2019 to 15,477 in 2024 a drop of 45%, while SMSFs per adviser has doubled from 20 to 40, with SMSF net assets climbing from AU$23m to AU$57m, a growth factor of 150%.

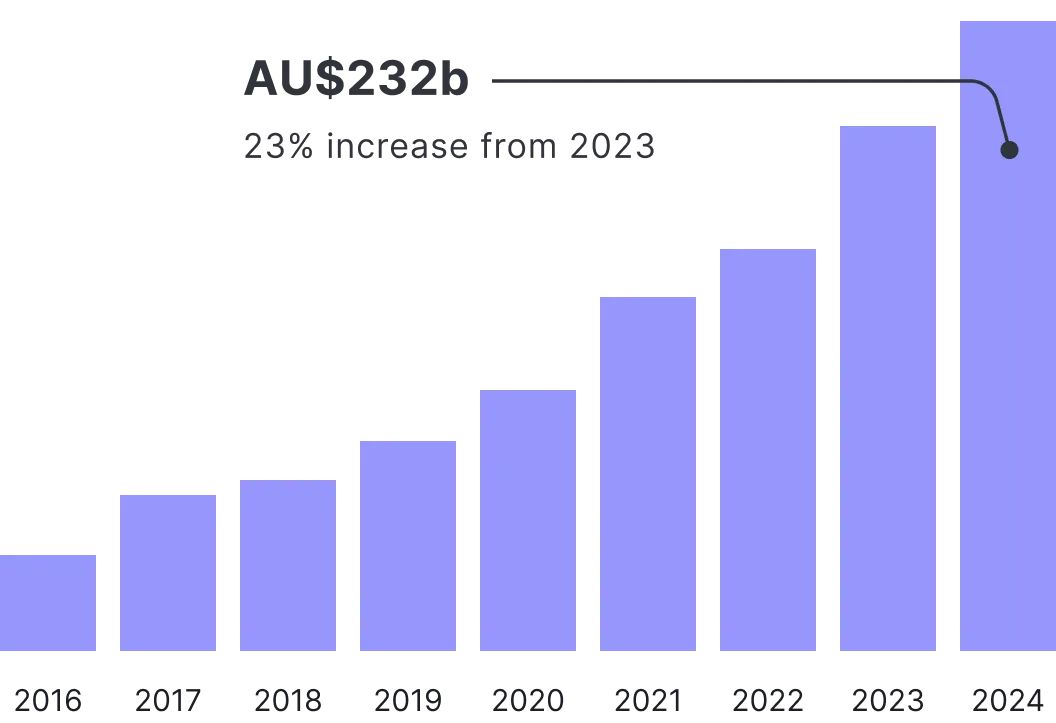

Surging Managed Accounts

The managed account sector in Australia is experiencing incredible growth in the adviser led SMA and MDA managed account markets, reaching AU$232.7 billion in AUM to December 2024 (a 23.2% increase from 2023), on net inflows of AU$14.3 billion.

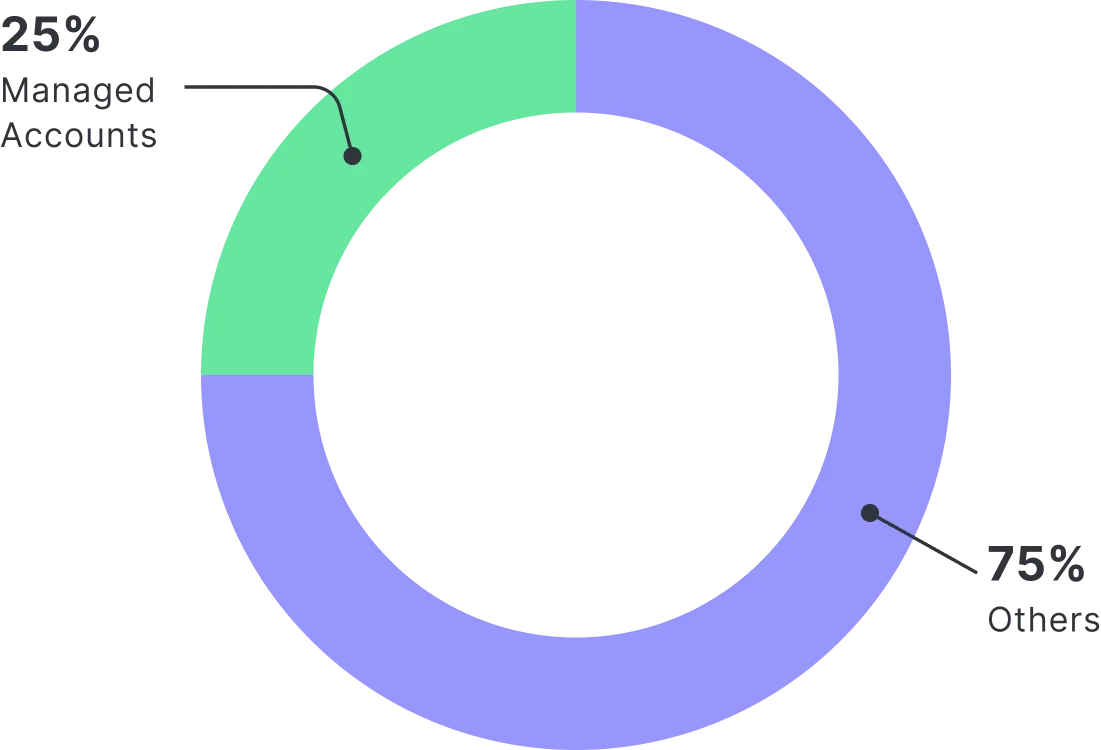

New Client Inflows

According to a report by Investment Trends and State Street Global Advisors, managed accounts currently represent 25% of all new client inflows. Furthermore, 56% of financial advisers are already utilising these solutions, with this figure projected to climb to 75% in the near future.

Private markets are growing at double the rate of public markets

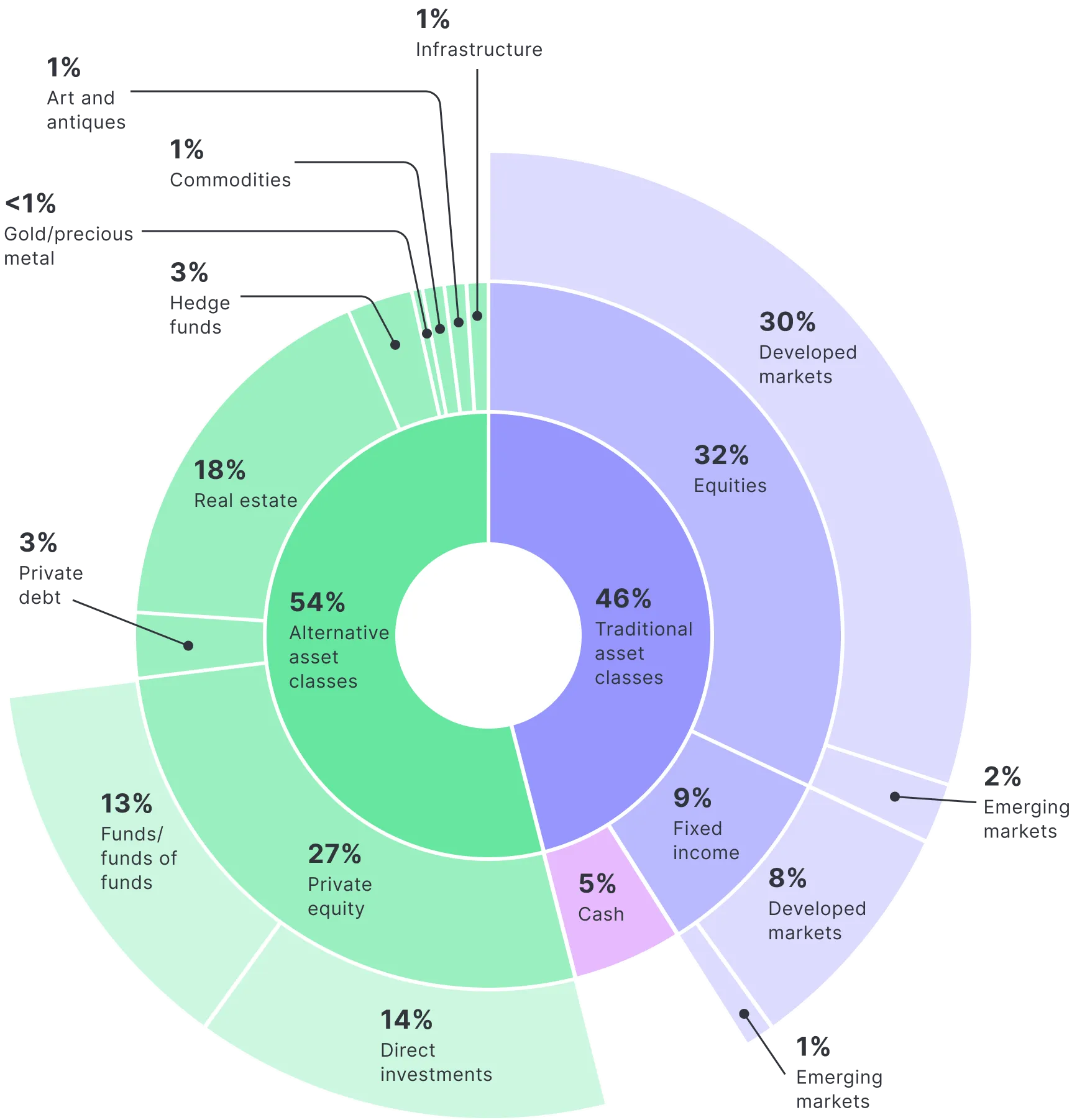

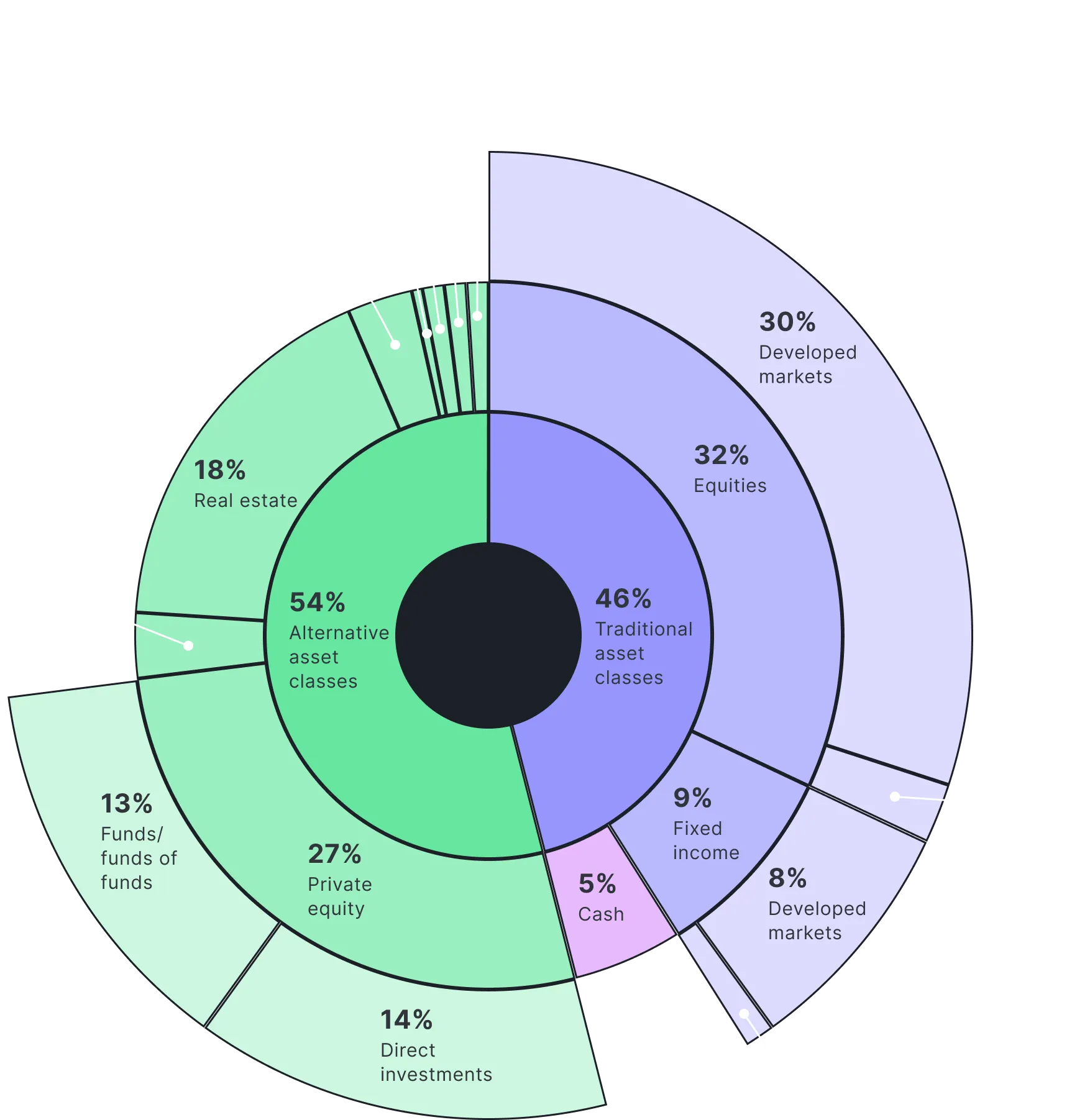

Private equity, credit, infrastructure, and real assets are expanding rapidly as investors seek higher returns, diversification, and protection from public market volatility. This trend reflects a structural shift in portfolio construction, with growing demand for access to unlisted and alternative assets.

Source: UBS Global Family Office Report 2025

Distribution challenges create opportunity for technology led solutions

Distribution is undergoing significant transformation

The Australian funds management distribution market is experiencing rapid and transformative change, shaped by evolving investor preferences, market consolidation, client channel shifts, regulatory developments, and the growing prominence of alternative investments.

Exchange-traded funds are experiencing record demand

Investor appetite for cost-effective and flexible investment solutions has driven Australian ETFs to a record AU$140 billion in assets under management as of late 2024, with the sector growing at an annual rate of 40% over the past decade, according to Morningstar.

The rise of direct to consumer distribution technology

To stay competitive and drive growth, wealth managers must rethink their distribution strategies to expand access to retail investors, embracing digital-first engagement, and investing in the technology required to deliver seamless, high-quality, consumer-grade experiences.

Let’s talk about how Assetly’s white-label solution can benefit your business

Assetly is still building its technological foundation and product stack, as well as securing the appropriate licenses and authorisations it needs to offer its products to the market.

Get in touch and we will put you on the waitlist for our beta version when we go live.

Subject

Message

Related Articles

Startups

AdviserVoice

Australian Wealth Managers bet on Private Assets and AI to supercharge growth

7 Apr 2025

Startups

Forbes

AI is Changing the Wealth Management Industry… Forever

25 Feb 2025

Investing

TradersMagazine

Fund Managers Innovate to Unlock Retail Access to Private Markets

21 January 2025

Investing

KeeganAdams

Funds Management Distribution Market Update 2025

14 January 2025