Assetly is democratising access to sought after alternative asset classes.

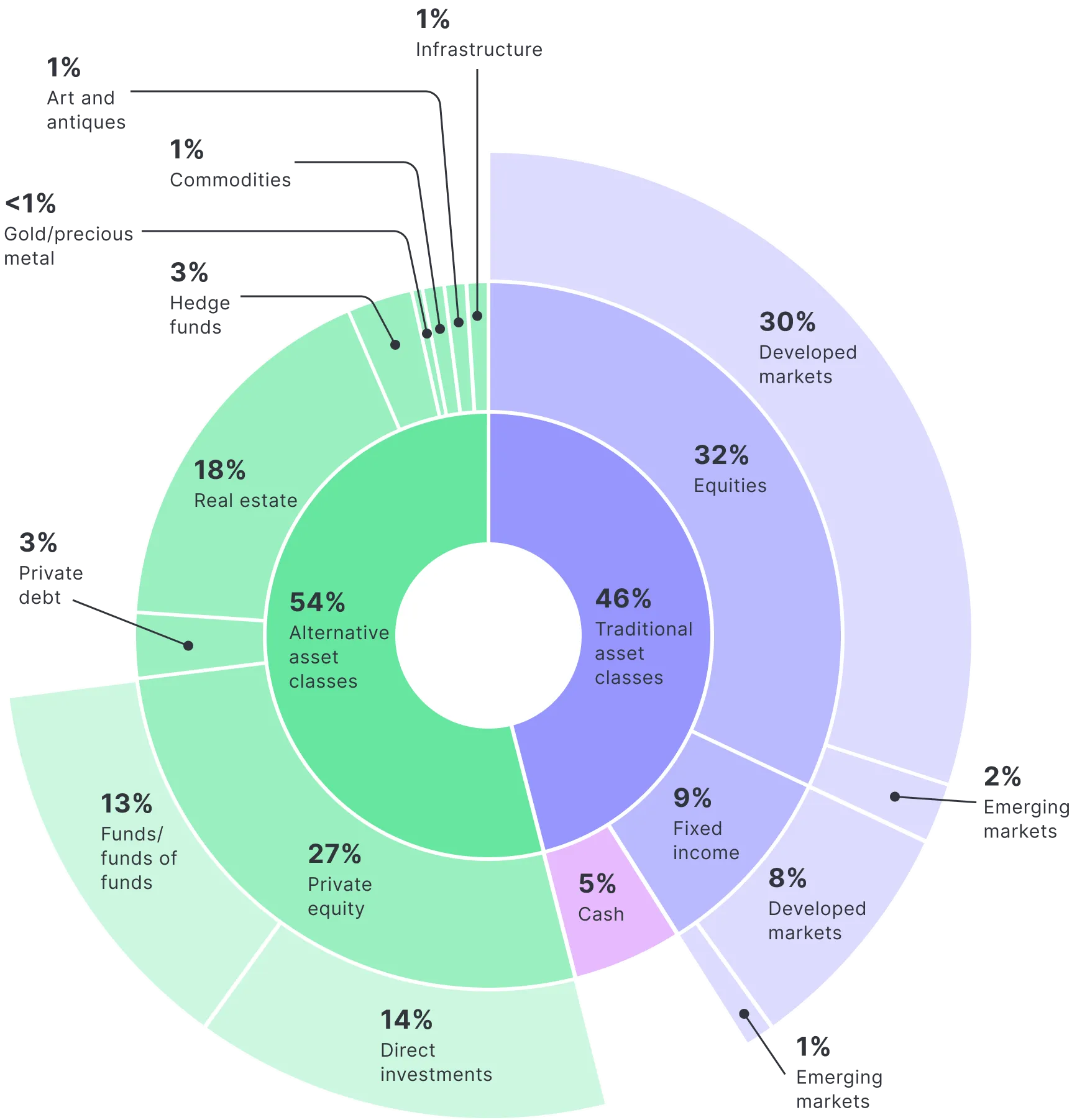

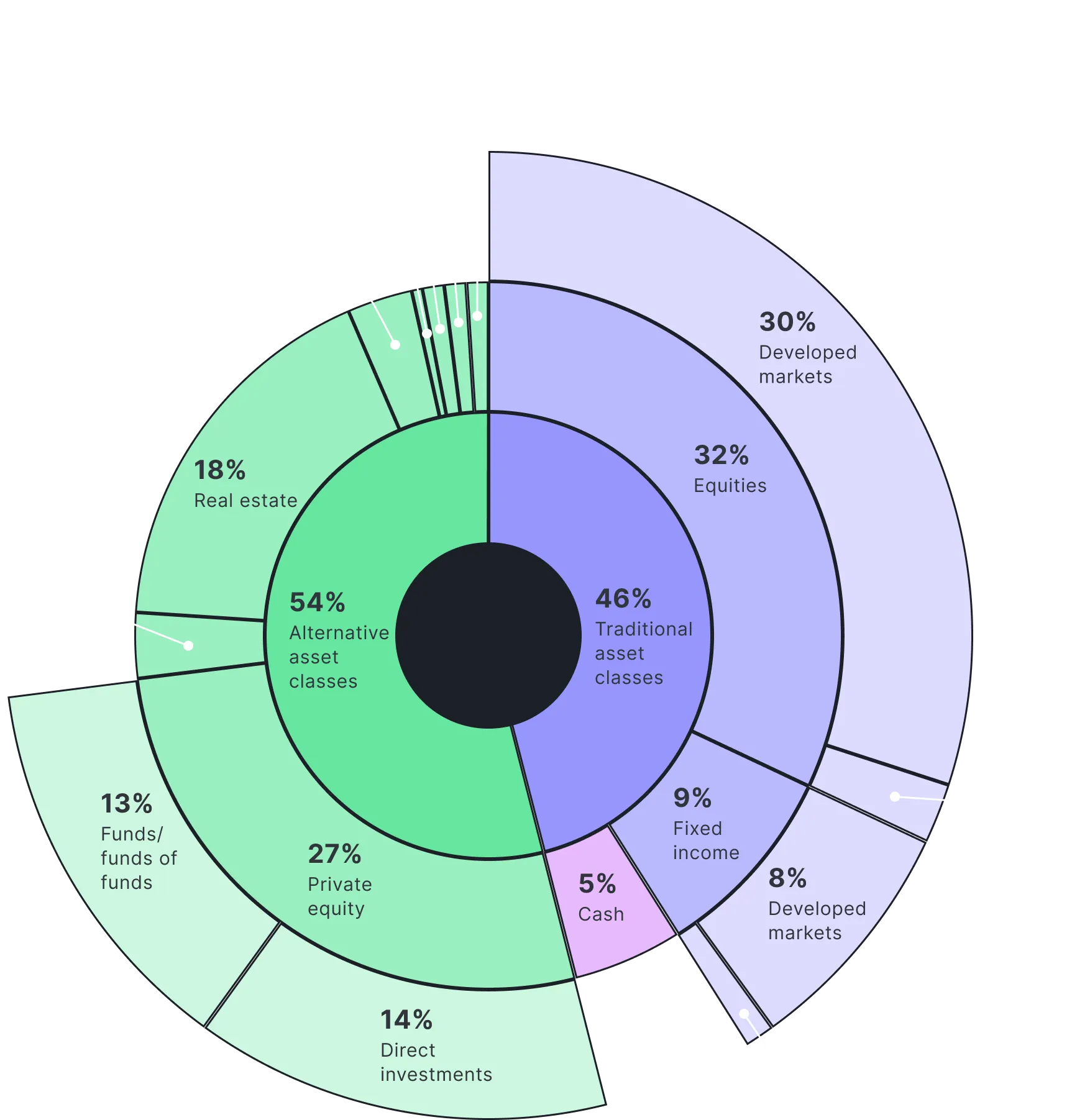

According to UBS, family offices of the ultra wealthy in the United States invest an average of 54% into illiquid or semi-liquid alternative assets classes.

Time to rethink your portfolio.

Source: UBS Global Family Office Report 2025

Firstly, we are rebuilding private markets infrastructure

Assetly is developing and integrating an end-to-end managed funds framework to enable fractional access to a broad range of capital markets and alternative asset funds, both internal (overseen by our highly experienced quantitative investment team), and external fully vetted funds within our marketplace.

Assetly’s solution covers the full investment lifecycle, including identity verification (KYC and KYB), access to public and private market offerings, wholesale and retail onboarding, digital applications, cashflow management, unit or share registry, and investment and redemption processing.

We aim to re-engineer private markets infrastructure, through an API driven and white-label service layer, providing seamless integration for partners and investors that unlocks wealth every step of the way.

Then, our next generation investment technology will change how people interact with their wealth

Platform features:

Automated Managed Account Technology

Assetly is developing our own proprietary and innovative cashflow and investment technology powered by an AI agent that will define a new generation of investment accounts, which we call ‘Automated Managed Accounts’ (or AMA’s) for individuals, high net worths, family offices, and institutional clients.

Sophisticated Investment Algorithm

The AI agent, and proprietary algorithm that powers the AMA, will rebalance the portfolio daily, taking into consideration distance from model, client cashflow forecasts, trading fees, tax effects, ESG, the investment universe, and the cost / benefit of delay using long horizon optimisation simultaneously for the portfolio and its sub-portfolios.

Full Native Access to Client Data

Native access to Assetly’s client data enables the AMA to understand the client from a holistic viewpoint, including its cash positions and investments across legal entities, tax and accounting data within their SMSF, upcoming payments and cashflow requirements, as well as superannuation contribution limits to maximise tax benefits.

Cashflow Scheduling Engine

Clients will be able to setup auto investment and auto drawdown rules according to set criteria, enabling the client to effectively invest lumpy sums automatically while in the accumulation phase, and conversely automatically drawdown funds to cover their lifestyle in the pension phase.

Clients can create an automated portfolio in minutes with AI

Intelligent cashflow and wealth management automation

Assetly’s technology is being built to automate the deployment of capital to ensure every dollar is working efficiently and surplus cash is intelligently allocated across investments based on goals, risk profiles, and market conditions.

Continuous monitoring of cash positions

Automatic allocation to ETFs, equities, and alternatives

Smart reinvestment of distributions and dividends

Daily tax-aware portfolio rebalancing

AU$5.50

per month

For Accounts Under AU$20k

0.33%

per year

For Accounts Over AU$20k

Includes:

Investment Plan

Risk Profiling

Auto Invest & Drawdown

Auto Rebalancing

CGT Consideration (by tranche)

Investment Universe

ESG Blacklist

Related Articles

Startups

AdviserVoice

Australian Wealth Managers bet on Private Assets and AI to supercharge growth

7 Apr 2025

Investing

TradersMagazine

Fund Managers Innovate to Unlock Retail Access to Private Markets

21 January 2025

Investing

Bain&Company

Private Asset Investing Desperately Needs New Market Infrastructure

6 July 2023

Investing

TechCrunch

The alternative asset class needs new infrastructure — who will build it?

14 September 2022