SMSF administration services for trustees and accountants.

SMSF admin services for trustees and accountants.

Assetly is building SMSF administration software and services for both trustees and practitioners.

Fully Outsourced

A painkiller designed to enable you to focus on actually building your wealth

Investment Universe

A wide range of asset classes and investment options for greater portfolio diversification

Cost Effective

Low-cost Standard or Premium SMSF administration with multiple effective add-ons

A complete end-to-end solution to assist you in building your wealth

Many investors choose to set up an SMSF to take control of their super, access a wider range of investment options, and build a retirement strategy that suits their goals. SMSFs offer flexibility to invest in assets like direct property, shares, and private investments, alongside valuable tax planning opportunities.

Key features:

SMSF Bookkeeping

Assetly process agents prepare each outstanding financial year, collect documents and build accounts

SMSF Accounting

Assetly manages all ongoing SMSF accounting and compliance requirements, including ad-hoc services

SMSF Audit

Pre-audit requirements are met by Assetly and completed by our highly experienced Audit partner

Tax Lodgement

Streamlined tax st atement preparation and one-click lodgement with the ATO reduces data entry and accelerates end-of-year tax processing

Discover the strategic advantages of getting your SMSF managed by Assetly

Ecosystem benefits:

Control and Autonomy

Full control over your retirement savings and investment strategies

Automated Investing

Setup your investment plan and automate cashflow and investments

Diversification

Access a wider range of investments, including illiquid alternative asset classes

Tax Planning

Tailored tax strategies around contributions, income, and retirement

Estate Planning

Greater control over how super benefits are passed to beneficiaries

Visibility

Full visibility into investment performance, fees, and SMSF operations

AI Driven Support

Communicate through a single command centre with AI driven support services

Cost Efficiency

With larger balances, your SMSF can be more cost-effective than retail super

Track investment performance and tax reporting

Access an advanced suite of performance and tax related reporting for your SMSF considering a fuly integrated investment ecosystem.

Performance Reports

Performance

Total portfolio returns over the selected period, with sold securities included or excluded.

More Details

Multi-Period

Compares portfolio returns over different periods including the impact of sold securities.

More Details

Sold Securities

Total return on each security sold within the selected range.

More Details

Multi-Currency Valuation

Compares the value of each holding by investment type, country or market over any period or currency.

More Details

Future Income

Displaying expected dividend and interest payments.

More Details

Diversity

Displays portfolio breakdown across GICS sectors, investment types, countries, and markets.

More Details

Contribution Analysis

Displaying how each of the holdings or asset allocations have contributed to the total portfolio performance.

More Details

Did you know that most SMSF trustees need more support?

SMSF cash often remains uninvested, reducing overall portfolio performance. With automated investing options, excess funds can be algorithmically allocated to indexed ETFs, potentially increasing returns by approximately $10k per year on a $1m balance.

The average trustee only spends 3.2 hours per month on research

Generating underperformance due to unskilled investment selection

With the average cash balance in an SMSF sitting at 20% of assets

Assetly is declaring war on lazy cash with our Automated Managed Account

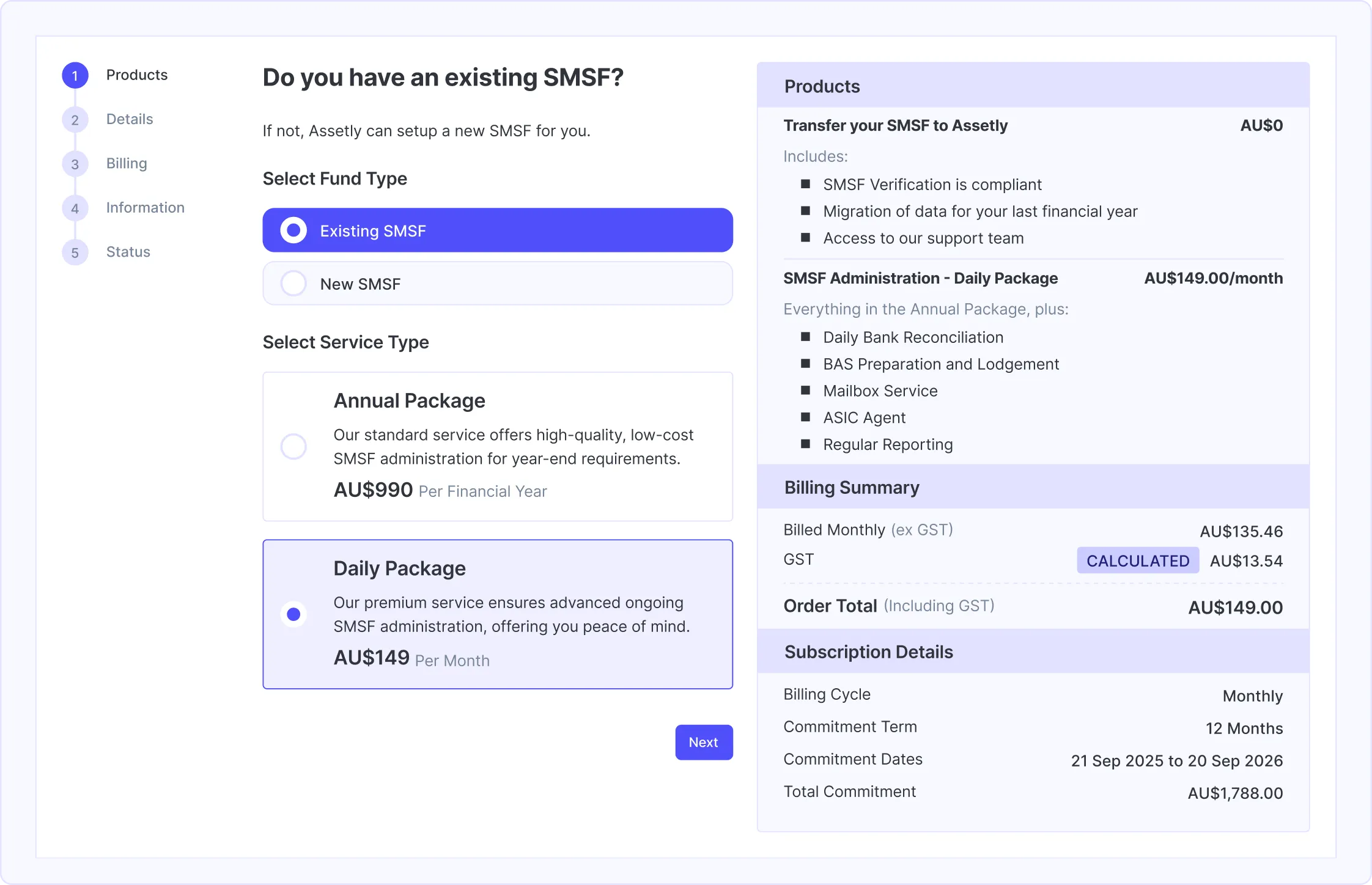

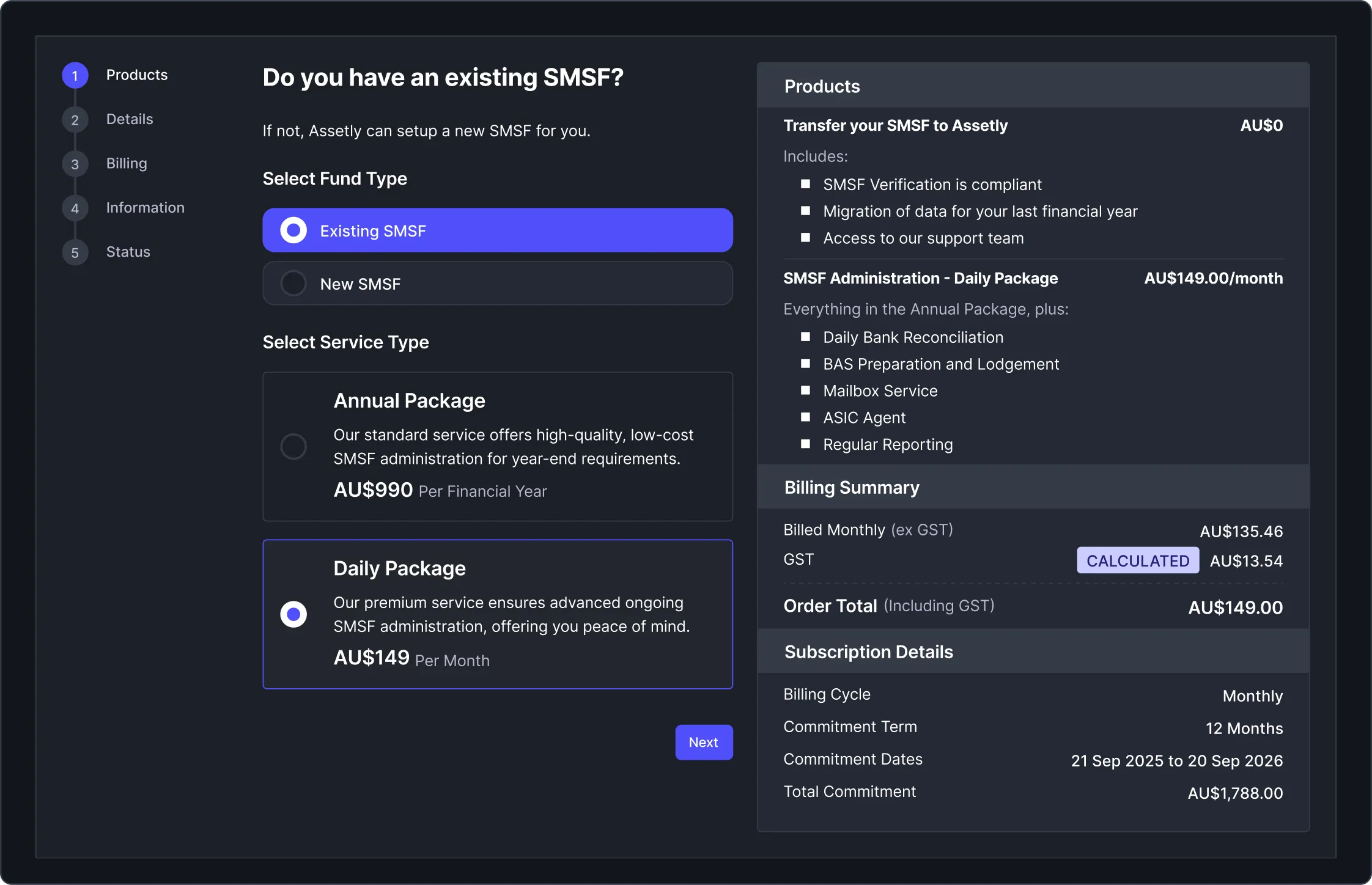

Our standard service offers high-quality, low-cost SMSF administration for your year-end requirements.

Includes :

SMSF Accounting Software

Data Entry (end of year)

Accounting

Independent Audit

End of Year Financials

Tax Return Lodgement

Price excludes applicable government fees.

Our premium service ensures unparalleled ongoing SMSF administration, offering you peace of mind.

Everything in Standard, plus :

Daily Bank Reconciliation

BAS Prep and Lodgement

Mailbox Services

ASIC Agent

Regular Reporting (Monthly)

Price excludes applicable government fees and is a 12 months commitment.