Australia’s pension system is the 5th largest in the world.

Australia’s superannuation sector exceeds AU$4 trillion in total assets under management (AUM), while the SMSF sector alone is a powerhouse with approximately AU$1 trillion in assets.

The AU$1 trillion dollar SMSF vertical is an extraordinary multi-layered opportunity

The SMSF sector represents a dynamic and rapidly expanding area within Australia's investment landscape, offering unparalleled opportunities for financial independence, tax efficiency, and wealth diversification.

As a company deeply embedded in the uniquely Australian SMSF vertical, Assetly capitalises on this opportunity by unifying all fragmented service layers into a single, natively integrated platform.

Estimated market size:

TOTAL ADDRESSABLE MARKET

fee revenue (1% of AUM)

The TAM includes all SMSFs in Australia, representing 650k SMSFs, over 1.2 million members (5% of Australians), and AU$1 trillion in assets

SERVICABLE ADDRESSABLE MARKET

fee revenue (1% of AUM)

The SAM focuses on SMSF trustees and members actively seeking digital solutions, estimated to be 60% of the TAM, which is 390k SMSFs, 720,000 users, and AU$580 billion in assets

SERVICABLE OBTAINABLE MARKET

fee revenue (1% of AUM)

The SOM targets the early adopters and tech-savvy trustees, projected to be 20% of the SAM, equating to 78k SMSFs, 144,000 users and AU$117 billion in assets

Existing SMSFs Only (estimated fee revenue based on a percentage of total assets)

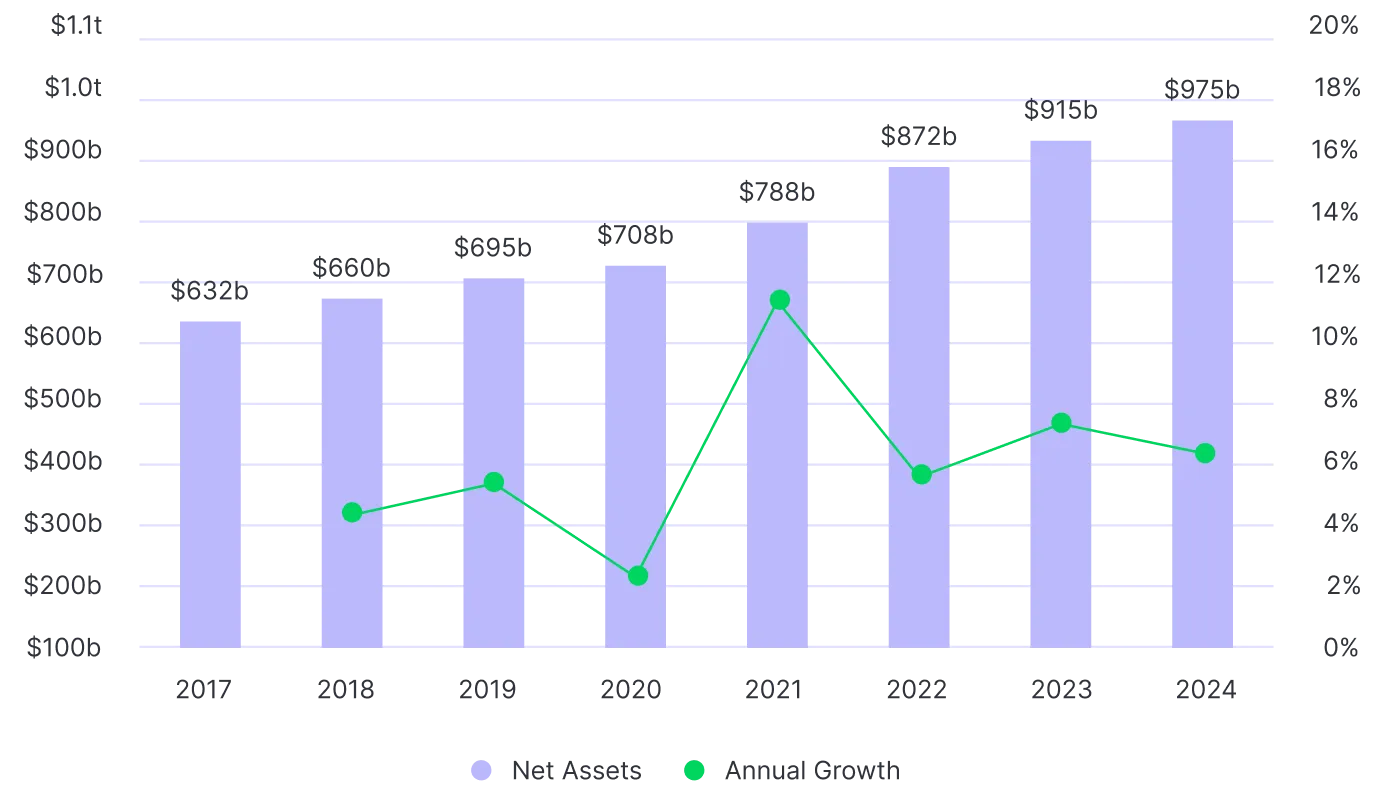

SMSF assets continue to surge while cash holdings remain high

As of December 2024, the SMSF sector comprises 638,411 funds with 1,184,287 members, collectively managing assets exceeding $1.02 trillion. This growth is fueled by younger Australians seeking greater control over their retirement savings, with a notable increase in SMSF establishments among individuals aged 35 to 44.

Market insights:

AU$1 trillion in assets and growing by an average of 6% per annum.

The average SMSF has around AU$1.5m in assets, while the median is AU$950k.

There is 650k SMSFs in Australia, with 30k new SMSFs setup in the last 12 months.

The average new SMSF has AU$420k in assets, representing AU$12 billion new capital.

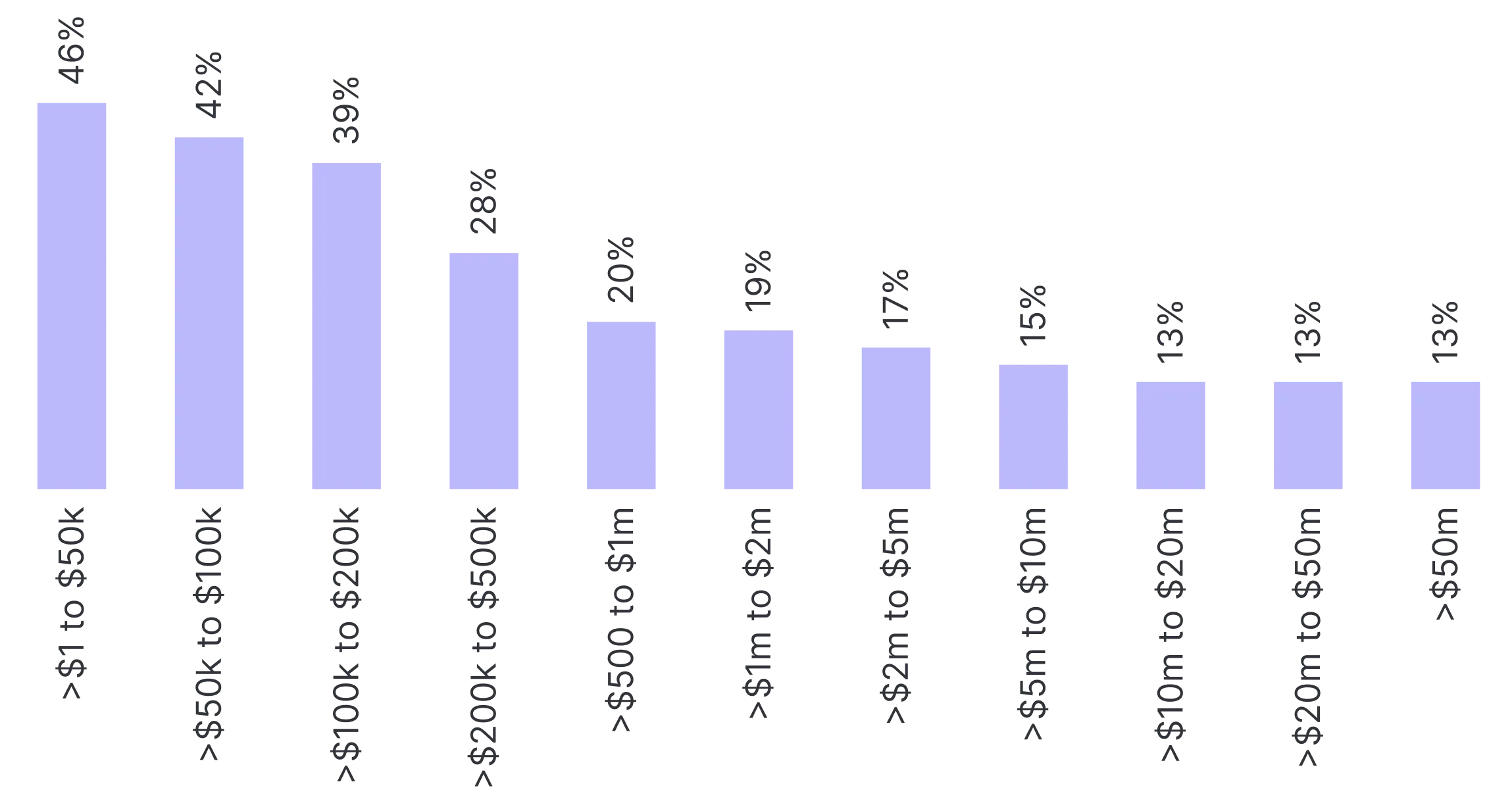

The average SMSF with assets of AU$500k to AU$1m has 20% sitting in cash.

Total SMSF Assets

Assets in cash by SMSF size

SMSF’s surge in popularity with the younger generation

Why are SMSFs so popular

Trustees are attracted to SMSFs due to greater flexibility over their super, more investment options, and more control

Younger Aussies are more tech savvy

Younger SMSF trustees of today grew up in a digital era, they have access to online content, and are more active traders

Super is more important to 47% of Aussies 18-24

According to superreview.com.au, 47% of Aussies between 18-24 regard super more important now than before Covid

Fastest growing SMSF cohort is the 35-44 age group

The fastest growing SMSF member age group is the technologically savvy 35 to 44 cohort, which is 35% of all new SMSFs

44% of new SMSF members are under the age of 45

Unlike retail super funds, SMSFs allow new trustees to invest directly into alternative assets for greater diversification

Investments in SMSF are on the rise

Trustees have significant disposable income, in FY2022 the avg non-concessional super contribution was $60k

Strong industry tailwinds provide a lucrative market opportunity for SMSF and roboadvice

Financial Advice

Over the last 5 years:

The number of financial advisers in Australia has fallen from a peak of 28k to 15k, a drop of 45%, while the number of SMSFs per financial adviser has doubled from 20 to 40, with SMSF net assets per adviser climbing from AU$23m to AU$57m, a growth factor of 150%, resulting in an increase in the cost of financial advice by approximately 40%.

Quality of Advice Review

Key findings:

The Australian Government’s Quality of Advice Review in Dec 2022 was initiated to address concerns about the accessibility, affordability, and effectiveness of financial advice, with key findings highlighting roboadvice as a way to expand access and reduce costs, alongside recommendations for technological innovation. Legislation is planned to be introduced by the end of 2025.

Superannuation Guarantee

Rate increase:

With the government mandated Employer Superannuation Guarantee rate recently increased to 12% on the 1st July 2025 (from 10% in June 2022), the Australian superannuation system is poised to experience an influx of significantly more capital.

SMSF Adoption

Lower cost of SMSF compliance:

Currently the average new SMSF entering the ecosystem has AU$420k in assets, however with Assetly’s low-cost bundled pricing model, clients with a super balance of AU$100k and above may be suitable based on a calculation of 1.3% in annual compliance fees, or an estimated cost of AU$1.3k per annum compared to the industry average of AU$3.5k+ per annum.

Related Articles